UCB tracking well towards full year financial outlook

- Revenue reached € 3.4 billion (+3%; +6% CER)

- Strong growth of UCB's five main products reached € 2.8 billion (+6%; +12% CER)

- R&D update: Cimzia® filed for non-radiographic axial spondyloarthritis (nr-axSpA) in the U.S.; Keppra® approved as monotherapy for epilepsy in China; rozanolixizumab achieved positive results and proof-of-concept in myasthenia gravis

- Financial outlook 2018 confirmed: Revenue expected to reach € 4.5 - 4.6 billion, recurring EBITDA1 should reach € 1.3 - 1.4 billion, Core EPS of € 4.30 - 4.70

BRUSSELS, Oct. 30, 2018 -- "We are pleased with UCB's performance in the first nine months of 2018, which is in-line with our financial outlook for 2018. Since June, we are launching CIMZIA® for patients with psoriasis in the U.S. and Europe with encouraging feedback. We are looking forward to bringing our epilepsy products to patients in China – where we pioneered with our extrapolation concept," said Jean-Christophe Tellier, CEO UCB. "Our pipeline again made good progress: supported by the positive results for rozanolixizumab in patients with myasthenia gravis, we are accelerating the clinical development of this important platform product."

Revenue for the first nine months of 2018 reached € 3.4 billion, +3% at actual and +6% at constant exchange rates (CER). Adjusted by the one-time other revenue in Q1 2017 of € 56 million for out-licensing the OTC-allergy drug Xyzal® (levoceterizine), revenue grew by 5% (+8% CER).

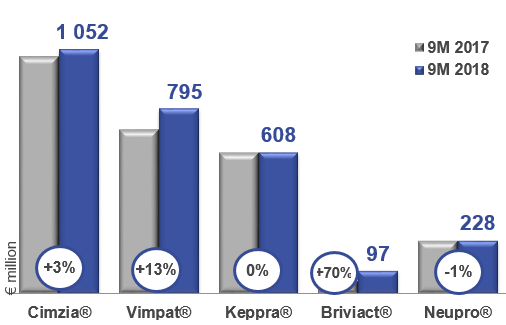

Core driver of the continued growth are UCB's main products - Cimzia®, Vimpat®, Keppra®, Briviact® and Neupro® - with combined net sales of € 2 780 million, +6% actual (+12% CER).

Financial outlook 2018 confirmed

2018 revenue is expected to reach € 4.5 – 4.6 billion. Recurring EBITDA in the range of € 1.3 – 1.4 billion. Core earnings per share are therefore expected in the range of € 4.30 – 4.70 based on an average of 188 million shares outstanding.

Key events: In September, in line with its strategic focus, UCB sold its subsidiary "Innere Medizin". "Innere Medizin" has been successfully promoting pharmaceutical products in Germany for many years, mainly in the internal medicine area for cardiovascular and respiratory diseases. Financial terms of the transaction were not disclosed.

R&D update – Neurology: In April, UCB agreed to acquire midazolam nasal spray from Proximagen and closed on the acquisition in June. This nasally administered investigational midazolam formulation is intended as a rescue treatment of acute repetitive seizures in patients with epilepsy. The new drug application was accepted for filing by the FDA in August, following previous orphan drug status and fast-track designation.

In July, positive phase 2 results were achieved for Briviact® (brivaracetam) in acute repetitive seizures.

UCB pioneered with the extrapolation concept in China: in March 2018 UCB filed Keppra® (levetiracetam) for monotherapy of partial onset epilepsy seizures based on extrapolation from adjunctive therapy with sound scientific rationale and was approved in August. Launch preparations are ongoing. In September, UCB submitted Vimpat® (lacosamide) IV and oral formulation for the adjunctive therapy of partial onset epilepsy seizures in children above 4 years and for adults, based on extrapolation.

In October, UCB announced positive results from a phase 2 study with a novel, subcutaneous FcRn (neonatal Fc receptor) monoclonal antibody, rozanolixizumab, in patients with myasthenia gravis (MG), achieving proof-of-concept. These results support the acceleration of rozanolixizumab development with a confirmatory study in MG starting in the second half of 2019.

Immunology: In September, Cimzia® (certolizumab pegol) was submitted to the U.S. regulatory authorities for non-radiographic axial spondyloarthritis (nr-axSpA) and was accepted for filing in October. In May this year, UCB announced positive topline results from a Phase 3 placebo controlled study to investigate the efficacy of Cimzia® on the signs and symptoms of active axSpA in patients without x-ray evidence of ankylosing spondylitis (AS) - the first phase 3 study to follow nr-axSpA patients for 52 weeks.

In August, the Japanese authorities approved the Cimzia® AutoClick® device.

In September, the label update for Cimzia® in pregnancy and breastfeeding was approved in Japan. Also in September and in Japan, positive phase 3 results were achieved for Cimzia® in patients with psoriasis and psoriatic arthritis.

In October, UCB and its partner Biogen announced top-line results from a Phase 2b study with dapirolizumab pegol (DZP) in moderately-to-severely active systemic lupus erythematosus (SLE). The primary endpoint of the study to demonstrate a dose response at 24 weeks on the British Isles Lupus Assessment Group (BILAG)-based Composite Lupus Assessment (BICLA) was not met (p=0.06). The study did demonstrate consistent and potentially meaningful improvements for the majority of clinical endpoints in patients treated with DZP compared with placebo. UCB and Biogen continue to further evaluate these data while assessing potential next steps.

All other clinical development programs are continuing as planned.

Immunology

Cimzia® (certolizumab pegol) for people living with inflammatory TNF mediated diseases contributed net sales of more than € 1 billion. The sustainable growth is driven by the recently launched new indications, with "women of child bearing age" label extension and psoriasis to have an impact in the future.

Neurology

Vimpat® (lacosamide) continues to reach more and more people living with partial onset seizure epilepsy and demonstrates sustainable strong growth in all regions with net sales of € 795 million.

Keppra® (levetiracetam) for epilepsy reached flat net sales of € 608 million with continued growth in international markets.

Briviact® (brivaracetam), available for people living with epilepsy continues to show strong growth - especially in the U.S. - and achieved net sales of € 97 million.

Neupro® (rotigotine), the patch for Parkinson's disease reached net sales of € 228 million. This is compiled of stable sales in the U.S., growing net sales in Europe and international markets with a decrease due to different shipment patterns for Japan. In-market growth in Japan is positive with +12%.

For further information

Investor Relations

Antje Witte,

Investor Relations, UCB

T +32.2.559.94.14,

antje.witte@ucb.com

Isabelle Ghellynck,

Investor Relations, UCB

T+32.2.559.9588,

isabelle.ghellynck@ucb.com

Corporate Communications

France Nivelle,

Global Communications, UCB

T +32.2.559.9178,

france.nivelle@ucb.com

Laurent Schots,

Media Relations, UCB

T+32.2.559.92.64,

laurent.schots@ucb.com

Allyson Funk

Head of U.S. Communications, UCB

T +1 770.970.8338

ally.funk@ucb.com

About UCB

UCB, Brussels, Belgium (www.ucb.com) is a global biopharmaceutical company focused on the discovery and development of innovative medicines and solutions to transform the lives of people living with severe diseases of the immune system or of the central nervous system. With more than 7 500 people in approximately 40 countries, the company generated revenue of € 4.5 billion in 2017. UCB is listed on Euronext Brussels (symbol: UCB). Follow us on Twitter: @UCB_news

Forward looking statements

This press release contains forward-looking statements based on current plans, estimates and beliefs of management. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including estimates of revenues, operating margins, capital expenditures, cash, other financial information, expected legal, political, regulatory or clinical results and other such estimates and results. By their nature, such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions which could cause actual results to differ materially from those that may be implied by such forward-looking statements contained in this press release. Important factors that could result in such differences include: changes in general economic, business and competitive conditions, the inability to obtain necessary regulatory approvals or to obtain them on acceptable terms, costs associated with research and development, changes in the prospects for products in the pipeline or under development by UCB, effects of future judicial decisions or governmental investigations, product liability claims, challenges to patent protection for products or product candidates, changes in laws or regulations, exchange rate fluctuations, changes or uncertainties in tax laws or the administration of such laws and hiring and retention of its employees.

Additionally, information contained in this document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction. UCB is providing this information as of the date of this document and expressly disclaims any duty to update any information contained in this press release, either to confirm the actual results or to report a change in its expectations.

There is no guarantee that new product candidates in the pipeline will progress to product approval or that new indications for existing products will be developed and approved. Products or potential products which are the subject of partnerships, joint ventures or licensing collaborations may be subject to differences between the partners. Also, UCB or others could discover safety, side effects or manufacturing problems with its products after they are marketed.

Moreover, sales may be impacted by international and domestic trends toward managed care and health care cost containment and the reimbursement policies imposed by third-party payers as well as legislation affecting biopharmaceutical pricing and reimbursement.

1 EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization charges

CER = constant exchange rates; All figures are unaudited.

Choose Country

- Global Site – English

- Australia – English

- België – Engels

- Belgique – Anglais

- Brasil – Português

- България – Български

- Canada – English

- Canada – Français

- 中国 – 中文

- Česká Republika – Angličtina

- Danmark – Engelsk

- Deutschland – Deutsch

- France – Français

- España – Español

- Ελλάδα – Ελληνικά

- India – English

- Ireland – English

- Italia – Inglese

- 日本 – 日本語

- Казахстан – ағылшын тілі

- 한국 – 한국어

- Luxembourg – Anglais

- Luxemburg – Engels

- Magyarország – Angol

- México & Latinoamérica – Español

- Nederland – Engels

- New Zeeland – English

- Norge – Engelsk

- Österreich – Deutsch

- Polska – Polski

- Portugal – Inglês

- România – Engleză

- Россия – Русский

- Slovensko – Anglický

- Suomi – Englanti

- Sverige – Engelska

- Schweiz – Deutsch

- Suisse – Français

- Türkiye – Türkçe

- Україна – Англійська

- United Kingdom – English

- U.S.A. – English